Guide to Formulating with Probiotics in Dairy and Alternative Dairy Markets

In a food and beverage market brimming with options, consumer interest in dairy and alternative dairy products continues to grow steadily. As more consumers become aware of their health, especially in light of the pandemic, they are carefully considering their options. While conditions like lactose intolerance have long been a concern, some consumers are turning to alternative dairy products for a variety of health benefits. A growing focus on wellness is creating new demand for dairy and alternative dairy products, with added functional benefits like probiotics to help enhance the health halos of these categories, and the markets are responding.

In this guide we focus on:

- How consumer demands are influencing growth in both the dairy and alternative dairy markets

- Why probiotics are an especially good fit for dairy and alternative dairy products

- Formulation opportunities to add the probiotic benefits consumers want to dairy and alternative dairy products

The dairy market has thrived during the current pandemic. Euromonitor International reports that as of August, 2020, the market had an estimated overall value of $585 billion USD, with a predicted CAGR of 2% through 2025.

Primary consumer drivers in this market include:

- The comfort factor: Over the last year, consumers have yearned for simpler times and sought dairy products, like ice cream, with an indulgent or nostalgic feel, or ones that evoke emotions of comfort.

- The association with health: Consumers have traditionally believed dairy products to be healthy choices. In the 5 years ending in Q3, 2020, “supporting health” was one of the fastest-growing positionings for the global milk market, according to Innova.

Global milk market: fastest-growing positionings (% CAGR 5 years ending Q3 2020)

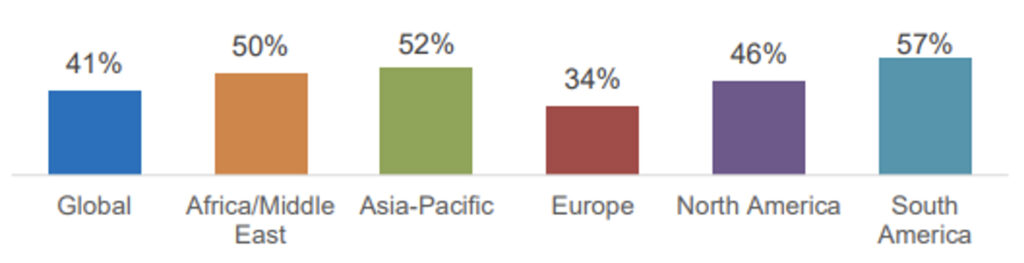

Interest in the alternative dairy market is on the rise globally as well, with over half of consumers in some regions interested in plant-based versions of dairy products.

Proportion of consumers who say they turn to dairy alternatives, 2020

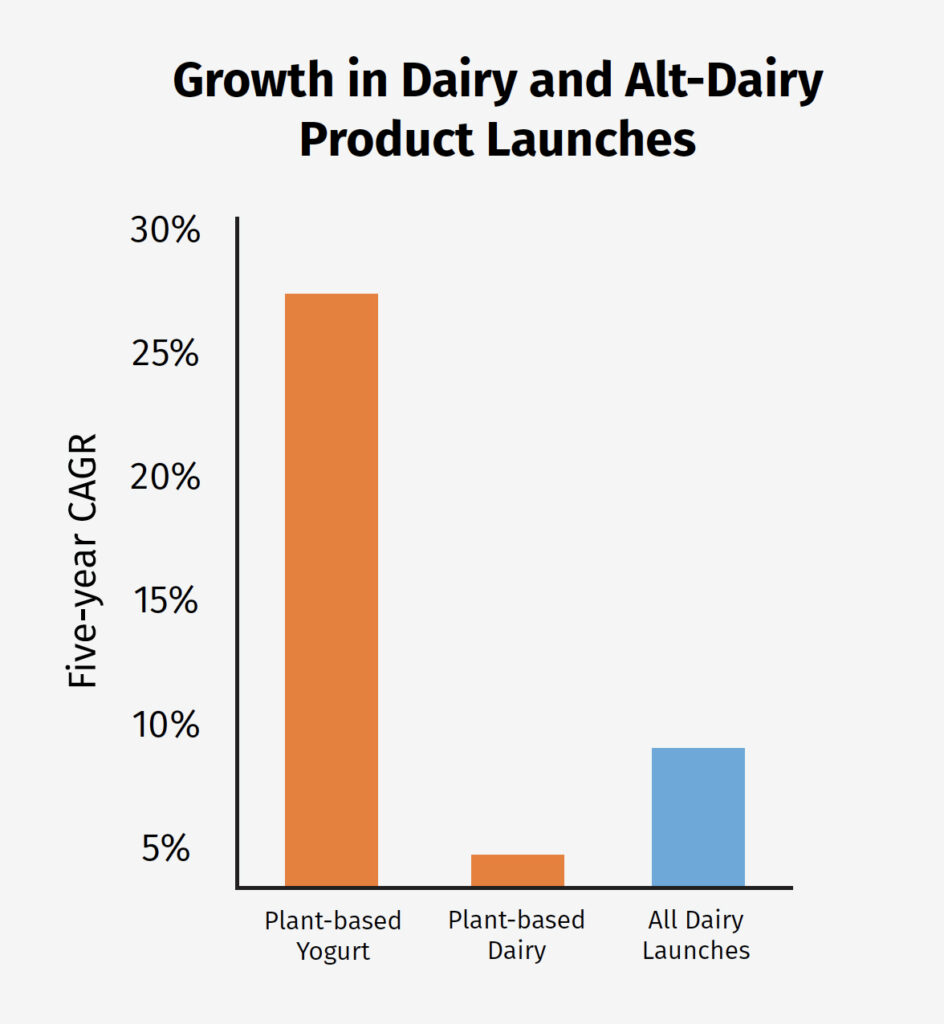

Through July 2020, a recent market report showed overall launches of dairy products grew at a five-year CAGR of 3.9%. By contrast, plant-based drink launches grew by 9%. In just one example of this dynamic growth, the figure for plant-based spoonable yogurts was 27.1%.

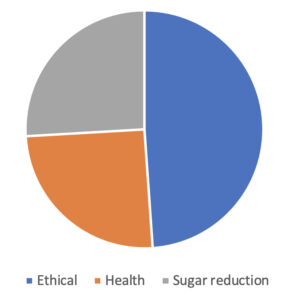

Growth in this market can be attributed largely to these factors:

- Lactose intolerance. The growing incidence and awareness of lactose intolerance is fueling demand. In Asia, where 90% of people are lactose-intolerant, the lactose-free market is already worth over $900m.

- Plant-based options. Consumers are replacing animal-derived foods and beverages with plant-based alternatives, a trend that appears to have increased as a result of the pandemic. In China, 25% of consumers said in a 2021 survey that the pandemic has encouraged them to eat fewer animal products, with similar numbers in Germany and Thailand saying the same.

- Ethical choices. A growing demand for options that are seen as healthy and sustainable, with non-dairy seen as a viable option. Dairy product launches with Non-GMO or Organic claims in North America have grown 33% from 2017 to 2019.

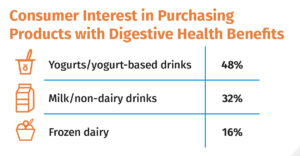

Adding probiotics to dairy and alternative dairy products is an opportunity to enhance these products’ health halos. And consumers are particularly aware of the role of probiotics in digestive health. Kerry’s 2019 global survey of over 11,000 health-conscious consumers in 14 countries showed strong interest in both dairy and alternative dairy products with probiotic benefits.

Why are Probiotics a Good Fit for Dairy and Alternative Dairy Products?

Because dairy was historically used to promote digestive health, yogurts and fermented drinks were some of the first product categories to emerge. Innovations like branded probiotics, science-backed ingredients, and highly stable spore-forming strains have all created new possibilities. And today, demand for digestive health benefits in both dairy and alternative dairy products is particularly high.

What Difference Does a Spore-former Make?

With products typically found in the refrigerated case, vegetative probiotics, which also require refrigeration, could be used. Growing interest in emerging product formats, like powdered and shelf-stable milk, especially during the pandemic, have caused manufacturers to look beyond the dairy case for spore-forming probiotics that can maintain their benefits without refrigeration while withstanding the rigors of manufacturing and temperature extremes to remain viable in the gut.

In the dairy and alternative dairy space, highly stable spore-forming probiotics backed by research have created new possibilities, from traditional milks and yogurts to powdered and plant-based versions, and more, with digestive health benefits. BC30™ (Bacillus coagulans GBI-30, 6086) is a spore-forming probiotic and a perfect choice for both dairy and alternative dairy applications because it is:

- Research-backed: Supported by over 25 published studies, which demonstrate a range of benefits for both digestive and immune health, it meets the growing consumer demand for scientific substantiation.

- Stable: BC30 can survive a wide variety of manufacturing conditions and temperature extremes until it reaches the gut, where it confers its benefits.

- Supported: BC30 makes it easier for food and beverage manufacturers to create benefit-driven products consumers want most.

Sources:

Euromonitor Passport, August 2020

Innova Market Reports, 2020Mintel GNPD, August 2020

Mintel GNPD, August 2020

Kerry ‘Alternative Dairy Beverages’

Mintel Plant-based foods in a post-COVID-19 world

Mintel GNPD

Kerry Global Consumer Survey, Digestive and Immune Health, 2019